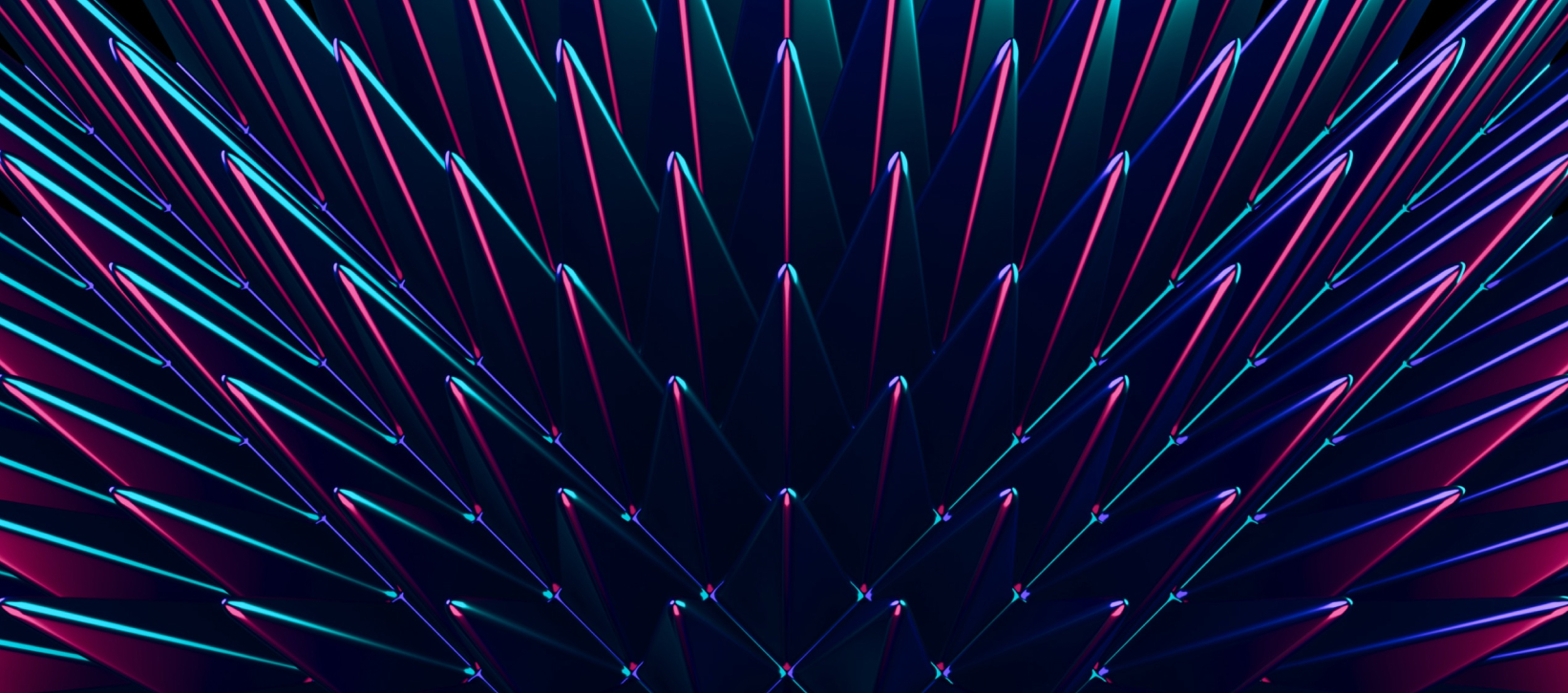

Is the future bright or dark for Asian startups?

| NS Weekly is a roundup of the latest Asian tech news. ‘NS’ is an acronym for NODESHORE, representing the N and S poles of a magnet. We gather news from across the globe and present it in an easy-to-read format. This series is published every Monday at 5 p.m. |

China’s Military AI Model and the Aftermath

ㆍChina has developed a military-grade AI model called ChatBIT, based on Meta’s AI model Lama2. The Chinese research team integrated around 100,000 military dialogue records into Lama2 to create ChatBIT, which is intended for use in the People’s Liberation Army’s strategic planning, simulation training, and command decision-making.

ㆍIn response to reports that its AI model is being used by the Chinese military, Meta has decided to increase its collaboration with U.S. defense agencies. While Meta previously restricted the military use of its Lama model, it is now working with U.S. defense organizations to make exceptions for defense agencies and contractors, marking the first official military application of the Lama model.

GlobalTix Doubles Revenue as Tourism Recovers in Southeast Asia

ㆍThe e-ticketing platform GlobalTix has reported a profit, with revenue more than doubling due to a recovery in Southeast Asia’s tourism market. According to audited financial statements for the year ending March 2024, profit before fair value adjustments reached S$45,000 (approximately $34,000).

ㆍWhile major airlines globally are feeling a “revenge travel” slowdown, with revenues dropping from their post-pandemic highs, travel service providers like GlobalTix continue to thrive. GlobalTix’s growth underscores the steady resurgence in travel demand across Southeast Asia.

Malaysia Sees ‘Incredible’ IPO Boom Continue in 2025

ㆍDespite a slowdown in IPOs across Southeast Asia, Malaysia remains a hotbed for listings, with Bursa Malaysia experiencing a standout year. Companies from diverse sectors, including palm oil production and grocery chains, have made new listings on the stock market, marking a “remarkable” period for the exchange.

ㆍAccording to Bursa Malaysia’s CEO, the exchange has reached a 20-year high with 50 new listings, driven by robust economic growth. He expects the IPO boom to extend into 2025, positioning Malaysia as a dynamic example of regional market resilience.

Key Highlights from the SK AI Summit 2024

ㆍAt the SK AI Summit 2024, South Korea’s SK Group Chairman Tae-won Choi stressed the importance of collaborating with global companies to drive AI innovation. Representatives from major tech players like Nvidia, Microsoft, TSMC, and OpenAI attended to explore AI services and potential partnerships using SK hynix’s high bandwidth memory (HBM) technology.

ㆍSK Group outlined ambitious AI infrastructure plans, including providing HBM3E samples early next year and mass-producing HBM4 in partnership with TSMC. The group also unveiled its ‘AI infrastructure superhighway’ strategy, which includes AI data centers and GPU cloud solutions. Choi highlighted the need for collaboration with partners to tackle AI innovation challenges.

What Trump’s 2024 Election Victory Means for Asian Startups

ㆍPresident Trump’s re-election is anticipated to bring wide-ranging impacts to Asian industries, especially in sectors like semiconductors, electric vehicles, and batteries, as well as stricter sanctions on Chinese companies. Asian businesses may need to adapt by increasing U.S. investments and relocating production facilities.

ㆍIn the semiconductor industry, TSMC and Samsung Electronics are planning approximately $117 billion in U.S. investments, with subsidies expected. The potential removal of the electric vehicle tax credit poses challenges for Korean battery firms, though it may offer advantages if restrictions on Chinese-made batteries persist. Meanwhile, sanctions against Chinese companies like Huawei and ByteDance are intensifying, prompting some firms to consider moving factories overseas.